I Bought Bitcoin??

This is a question I often ask myself when I open up my email inbox lately. Of course, it always ends up being a scammer sending me a fake Paypal invoice for “Bitcoin purchases”.

However, some recent data compiled at bitcointreasuries.net has me asking the same question about a significant number of ETFs we own or have an interest in via our Decathlon and BCM Sector products. After a quick overview of the dataset and the Bitcoin treasury companies, I will share some data and thoughts on indirect ownership of Bitcoin via ETFs.

The good news is, at this moment, most non-Cryptocurrency or block chain related ETFs do not have massive exposure to Bitcoin, but they do have more than most investors likely expect – in the worst cases enough to cause potential pain but not potential ruin unlike the scammer mentioned above. Read on to see how extensive that potential pain could be.

The Dataset

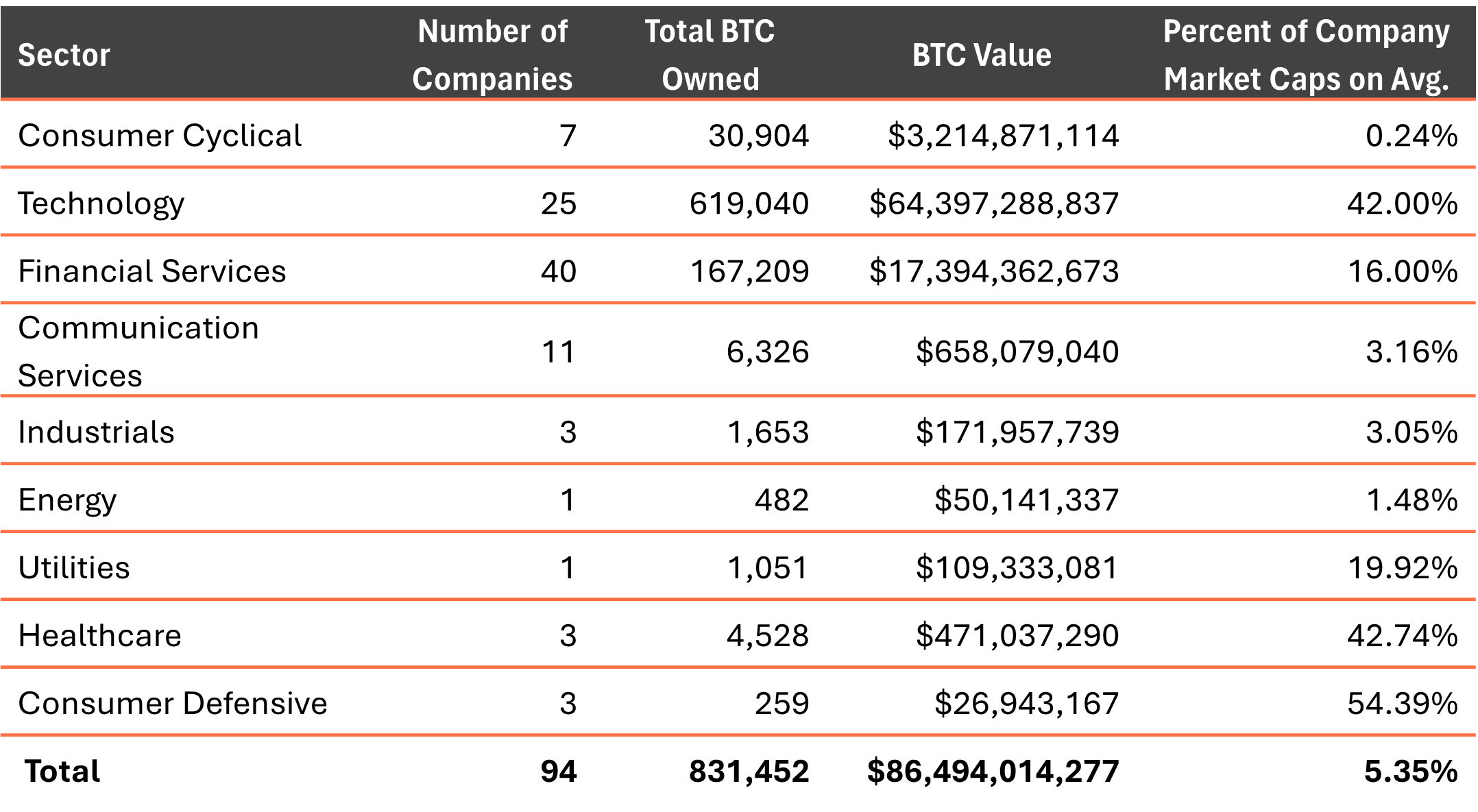

The dataset identified publicly traded companies (in addition to other entities) that report ownership of Bitcoin in their quarterly financial statements. I was able to map to 94 companies we have data on in our internal datasets.

While many of us are probably aware of the scale of Strategy’s* (formerly Microstrategy) Bitcoin holdings at this point, the list of corporate owners spans the spectrum from US megacaps to foreign microcaps, technology companies to health care companies.

*To avoid confusing the company Strategy with general use of the term strategy, I will italicize references to the company.

An Overview of the Companies

The 94 companies I analyzed own 831,452 Bitcoin, or just over 4% of all Bitcoin currently in existence as of 5/31/2025.[1] That represents an even larger percentage of Bitcoin’s estimated float – about 6%.[2]

The list includes 7 companies with market caps over $10B: Tesla, MercadoLibre, Strategy, Coinbase Global, Block, Gamestop and NEXON. Meaning, they likely appear near the top of the list in your average cap-weighted index ETF.

Prior to the SEC green-lighting Bitcoin (and other cryptocurrency-based) ETFs, buying stock in companies that had converted themselves into Bitcoin treasuries was the simplest way for the average investor to get Bitcoin exposure apart from buying it directly. Now, however, any investor can easily get direct exposure to Bitcoin by buying shares in any of the Bitcoin ETFs now out there.

In addition to being easier now, it’s also more efficient to directly buy the ETF. Even the most efficient Bitcoin treasury company (MARA Holdings) yields 89 cents of Bitcoin per $1 of stock purchased. The vaunted Strategy yields just over 60 cents of Bitcoin per $1.*

*All based on my analysis (see sourcing at the end).

How Much Bitcoin is in that ETF?

For the most part, the companies that are the largest holders of Bitcoin have made it quite apparent that holding Bitcoin in their treasuries is a corporate strategy. That is not always the case with ETFs.

Of the 94 publicly traded companies I analyzed, 34 of those companies appear in at least one US-issued ETF. I’ve identified 654 ETFs that have indirect ownership of Bitcoin due to owning one of the Bitcoin treasury companies, ranging from as little as $2.74 (Fidelity Metaverse ETF) of Bitcoin interest to over $1B (Invesco QQQ Trust). These ETFs in total have indirect ownership of 67,293 Bitcoin (about $7B dollars’ worth).

There were 29 ETFs I identified that explicitly invest in Crypto, digital assets, blockchain technology, or disruptive FinTech companies. I suspect customers are getting the crypto exposure they expect from these. In addition, 2 of the ETFs are single stock, leveraged Strategy ETFs. Finally, any ETF that has an investment universe that includes the NASDAQ will likely have some amount of Strategy exposure (hence QQQ having so much Bitcoin) and investors should expect to have some Bitcoin exposure at the outset. I’ve identified 34 of those.

Further filtering for ETFs with $100M or more in total assets results in a list of 28 ETFs with significant Bitcoin holdings (and likely more than investors who have not closely read the prospectus may expect):

Several of these ETFs appear in our Decathlon investment universe. At some of our position sizes, we could unwittingly own interest in as many as 25 Bitcoins at a time in Decathlon.

At this point, indirect ownership of Bitcoin via ETFs does not represent catastrophic risk to investors (at least within the curated list above). At the maximum (shown in the table), Bitcoin is 6.3% of total assets for the ULTY ETF down to 0.42% for VIOO. Meaning, if Bitcoin were to fall to $0, losses due directly to Bitcoin for these ETFs should be in the high single digits at worst.* This is definitely a risk to be aware of but at the moment not one that is potentially ruinous.

*Of course, something broader in the economy is likely going on if Bitcoin is falling to $0, which is why I stress due directly to Bitcoin.

Conclusion

I was genuinely surprised to learn the wide variety of ETFs that have indirect ownership of Bitcoin when I conducted this analysis. It serves as a good reminder that it is critical to look into the composition of any ETF being purchased to get a complete picture of the risks involved. I’d know what I was getting into buying a 2x Strategy ETF. Prior to today, I would not have necessarily expected that my vanilla S&P Small Cap ETF (IJR) has indirect ownership of 3,324 Bitcoin (about $357 million worth).[3]

I would say this lesson follows for index providers as well. Several of the companies identified as owning Bitcoin have pivoted their business strategies from completely unrelated sectors. As a result, they may show up in sector filtered ETFs (e.g., Healthcare) that have nothing to do with the digital currencies that have seemingly become these companies’ real business.

I encourage index providers and ETF issuers to more closely vet these Bitcoin treasury companies to make sure they still fit in their products. For example, Strategy made $111 million in software revenue in Q1 2025 while growing their Bitcoin holdings by $22 billion. Even when you remove losses due to changes in the price of Bitcoin, they had negative net income on the quarter and yet boast a market cap of over $100 billion[4] – clearly the company trades as a Bitcoin proxy rather than a software company. Should Strategy really be a significant weight in a Software and Technology ETF anymore?

Analysis Sourcing: bitcointreasuries.net for data on company Bitcoin ownership (no as-of date provided). Historical EOD Data for data on ETF holdings, stock market caps, ETF assets under management, and ETF prices. Yahoo was used on occasion to fill in gaps in the Historical EOD Data dataset. All of these datapoints were as-of 5/31/2025.

Disclosures:

Copyright © 2025 Algorithmic Investment Models. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Algorithmic Investment Models. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Algorithmic Investment Models.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

[1] Blockchain.com, Total Circulating Bitcoins as of 5/31/2025.

[2] BTCC Academy, btcc.com

[3] Source: bitcointreasuries.net for corporate Bitcoin ownership data (accessed on 6/18/2025). Historical EOD Data for ETF and underlying stock data (as of 5/31/2025). Includes internal analysis of the source data.

[4] Form 10-Q. QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended March 31, 2025, Strategy (Microstrategy Incorporated).