Our quantitative investment system is blissfully unaware of geopolitical events, social media (it must be nice) or the number of Tesla’s sold last quarter, but we believe global events leave a signature revealed through market prices and the relationships of the different assets within our investment universe. These “fingerprints” can offer probabilistic clues for a well-tuned model such as the one we use to guide our investment decisions.

We entered the quarter relatively defensively positioned and cautious. Fundamentally, our primary concern was about the cyclicality of AI spending and the increasing dominance of the companies associated with AI in global equity indices. From the perspective of our investment system, the technical backdrop of narrow market leadership and very strong recent market index performance triggered a heightened sensitivity to any increase in volatility that might preempt more material market weakness.

Early in the quarter we felt somewhat validated as the emergence of Deep Seek in China showed leading AI models could be built with far less computing resources than had been previously thought – putting a massive capital investment cycle at risk. Markets reacted in kind, even sending prices of relatively safe Utilities companies lower on the prospect of less electricity demand from power-hungry Tech data centers.

Throughout the quarter our systems generally reduced risk and avoided the growth stocks that dominate the indices. This risk reduction drove relatively strong results in a quarter when diversified asset allocated strategies generally outperformed U.S. equity indices.

All of that feels like a distant memory in the wake of “Liberation Day” on April 2nd.

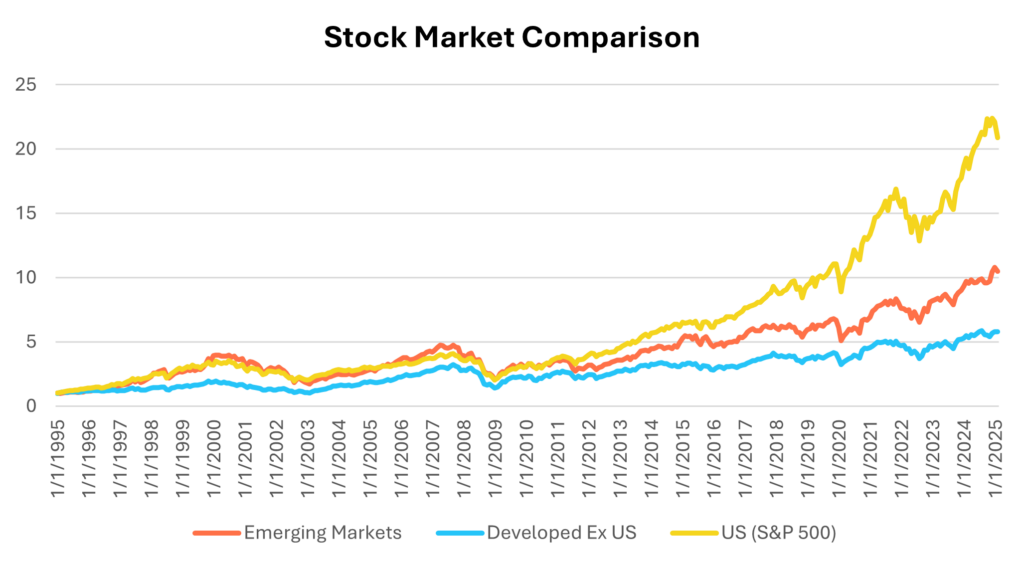

Before the massive ensuing sell-off, the market showed its hand revealing where the risks lie. During the first quarter, already the worst for stocks in two years, growth underperformed value, U.S. companies underperformed foreign ones, and the “Magnificent 7”[1] underperformed the average U.S. stock. This played out as a well-structured unwind of long-running secular trends.

Defensive posturing has been absolutely necessary in the week since the quarter ended. The day after President Trump’s announcement, relatively defensive sectors such as consumer staples substantially outperformed growthier sectors, but in the following day nearly all sectors fell the same. This “correlations to 1” phenomenon is common in extreme market events and perhaps indicates that there is a high probability of a short-term recovery after the indiscriminate selling.

We are optimistic that despite the pain we are seeing across markets, opportunities to reduce or increase risk as well as seek out specific themes will continue to emerge, and we hope to use our tactical nature to capitalize on them. Most recently, our most aggressive model added risk[2], seeking to capitalize on the carnage that has occurred thus far.

Tariffs

It is likely we’ve all read enough about tariffs over the last few days, so we’ll try to keep our thoughts brief – High Universal[3] Tariffs are simply a form of tax—and are obviously bad for the economy. The market is keenly aware of this and has been in a game of chicken with policymakers over if and when “a deal can be made”.

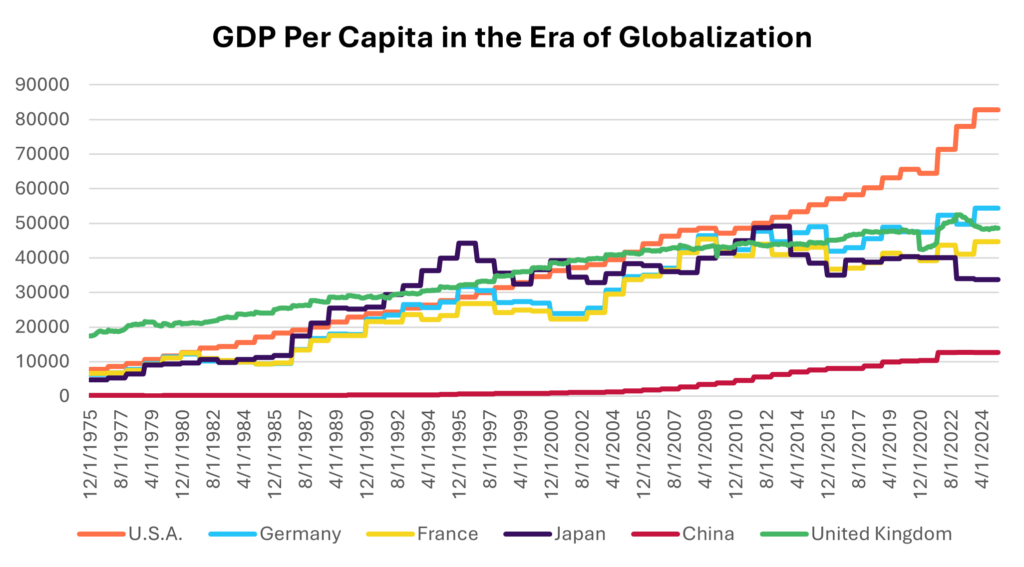

The U.S. economy has been the envy of the world since the advent of the internet age, with its relative strength only increasing in recent years on the back of our world-leading technology companies. It is difficult to find any economic measure in which the U.S. isn’t a major positive outlier. The only nations with higher GDP per capita are small tax havens, and only Japan currently has a lower unemployment rate[4]. This economic success has not come without costs – specific domestic industries have been deemphasized over time, and wealth and assets have appreciated far faster than incomes. Still, I believe it’s fair to say no country has benefitted more from globalization in aggregate than the United States. Large tariffs are an obvious attack on globalization, perhaps putting our global leadership at risk for the first time in decades.

While “tariffs” are one of our President’s favorites words, the real target revealed on April 2nd was trade deficits. The United States has large trade deficits with many nations on goods, while it has a trade surplus with the world on services. As a very wealthy country we have the capacity to buy a lot of cheap goods from countries like Vietnam, whose consumers are not wealthy enough to buy the expensive goods and services our country produces. It is hard to imagine any Americans would prefer the jobs or economy available in Vietnam to our own, but getting cheap apparel is certainly a benefit we all enjoy.

Despite our heft in the global economy, we likely have the most to lose from a trade war in the short term. We generally sell high value-add, high margin goods and services to the world and generally import low value-added goods. If tariffs were imposed across the world, higher margin goods and services are likely more discretionary and are most apt to “eat” the tax reducing profitability for U.S. companies. Conversely, the lower margin goods have no readily available substitute and are many multiples cheaper than their theoretical domestic equivalent with no margin to “share” and thus that tax gets passed directly to the (U.S.) consumer.

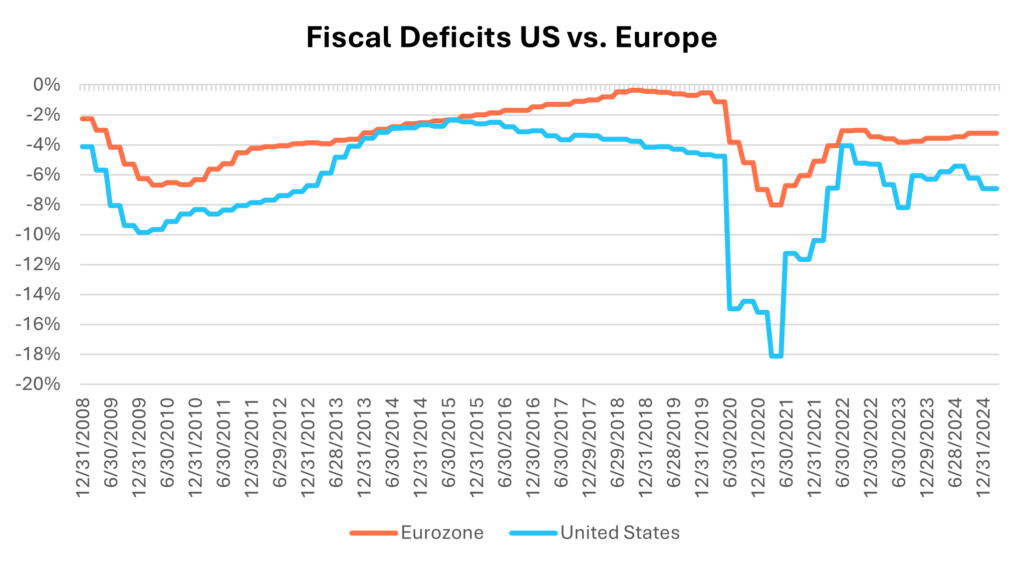

The first viable bull case for non-US equities?

A global trade war is unlikely to be to the benefit of foreign countries either and volatility will reverberate through global asset markets of all forms. That doesn’t mean it won’t create opportunities for investors. During the first quarter we saw a re-awakening in Europe. U.S. fiscal spending has far outstripped Europe’s, a tailwind for our economy and a headwind for theirs. We are likely at a turning point in this relationship. Europe is upping its defense spending and may be further emboldened as global trade lines are re-drawn.

We’ve mentioned China in past letters and the situation there is certainly complicated with the recent tariff announcements, but we saw continued progress in their domestic economy during the quarter. Despite the constant geopolitical headlines, it’s simply been China’s economic struggles that have driven poor investment returns for Chinese equities in the last few years. Should those troubles ease (a much bigger IF now) we’d expect equity performance to follow suit. Over the past few quarters the domestic economy in China has steadily improved and their equities have done quite well. Prior to the recent bout in volatility the FTSE China 50 Index returned 17.7% through the first quarter.[5]

Where do we go from here?

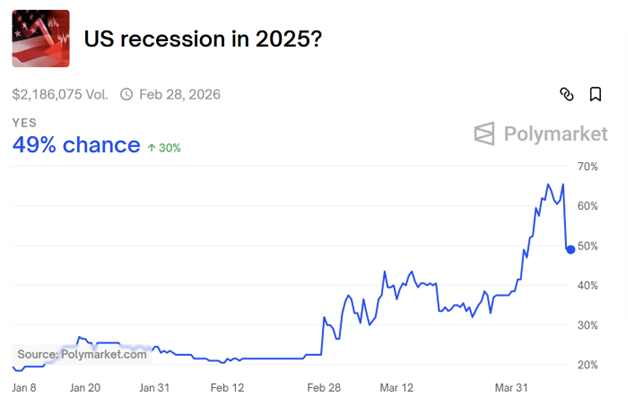

Markets trade on a weighted range of probable outcomes – not a single forecast – and that range may now be as wide as ever. We’ve seen the market fall as a reaction to this, with substantially increasing odds of a recession. Now that virtually everything can be gambled on, there is a fairly reliable market indicator of how those odds are changing (aside from the market itself of course). In the wake of liberation day announcements, they went to nearly 70% and have since retreated but remain very high.

While we believe the tariffs as originally proposed, and even a meaningful mitigation of those proposed, would lead to a recession quickly, we reserve some optimism that there has not been a massive misallocation of capital preempting a typical recession. We may also reserve some ignorance that it is hard to imagine a country doing this much self-harm unimpeded. The recent “pause” gives us further comfort in this regard. The lack of mal investment is akin to the situation we faced during the pandemic, which allowed for a rapid bounce back in economic activity. There is still time for a similar result, but each day that passes is another that nudges business leaders to pursue defensive actions in the face of uncertainty. Those actions could ultimately bring our economy to a screeching halt.

Human beings are not well adapted for thinking probabilistically – we have particular trouble disaggregating the odds of something happening from the ultimate result. We likely also over and underestimate the large outlier (positive and negative) events known as “tails.” Computers have no trouble thinking this way and we trained ours specifically to do so – perhaps their most powerful feature.

The current market should play to our system’s strengths. There will always be opportunities in uncertain environments, but mistakes will also be amplified. We will continue to monitor our systems in real time to seek to avoid any mistakes as we recognize the current market environment is the kind that can define an entire client experience. We remain focused on aligning with you and your clients’ financial goals.

For more insights from AIM’s portfolio managers, visit algomodels.com/our-thinking.

Disclosures:

Copyright © 2025 Algorithmic Investment Models LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Algorithmic Investment Models. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Algorithmic Investment Models.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

The S&P 500 Index measures the performance of 500 large U.S. companies across various industries and is weighted by market capitalization, giving larger companies greater influence on the index. MSCI Emerging Markets Index: The MSCI Emerging Markets Index is an unmanaged index that measures equity market performance in global emerging markets and is not available for direct investment. MSCI EAFE Index: The MSCI EAFE Index is an unmanaged index that tracks the performance of developed markets outside of the U.S. and Canada and is not available for direct investment. The FTSE China 50 Index is an unmanaged index that tracks the performance of the 50 largest Chinese companies listed on the Hong Kong Stock Exchange and is not available for direct investment.

The S&P 500 Equal Weight Index includes the same companies but assigns each an equal weight, offering a better representation of the “average” stock’s performance. The S&P Technology Sector Index focuses on technology companies within the S&P 500, heavily influenced by large-cap tech firms such as those in software, hardware, and semiconductors. The MSCI All Country World Index (ACWI) measures global equity performance, including both developed and emerging markets, providing a broad view of international stock markets. Finally, the S&P 10 refers to the ten largest companies in the S&P 500 by market capitalization, which can have an outsized impact on overall index performance due to their size. The CRSP US Large Cap Value Total Return (TR) Index tracks the performance of large-cap U.S. stocks classified as value-oriented, based on factors such as price-to-book ratios. The CRSP US Large Cap Growth TR Index represents large-cap U.S. stocks classified as growth-oriented, based on metrics such as earnings and revenue growth potential.

For Investment Professional use with clients, not for independent distribution.

Please contact your AIM Regional Consultant for more information or to address any questions that you may have.

Algorithmic Investment Models LLC (AIM)

125 Newbury St., 4th Floor, Boston, MA 02116 (844-401-7699)

[1] The “Magnificent Seven” stocks are a group of high-performing, influential, and large-cap tech companies: Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).

[2] In a fast-moving market things change quickly and so do our rankings, this reflects our models as of 4/7/2025 and could change in a matter of days.

[3] Specifically targeted tariffs, conversely, might be a useful tool to protect important domestic industries.

[4] Global unemployment rates of note: US 4.2%, UK 4.4%, Eurozone 5.7%, China, 5.4%, Japan 2.4%.

[5] Source: Bloomberg, total return 12/31/2024 – 3/31/2025.