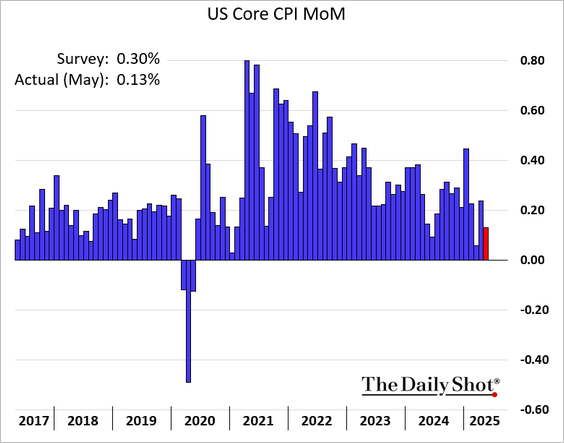

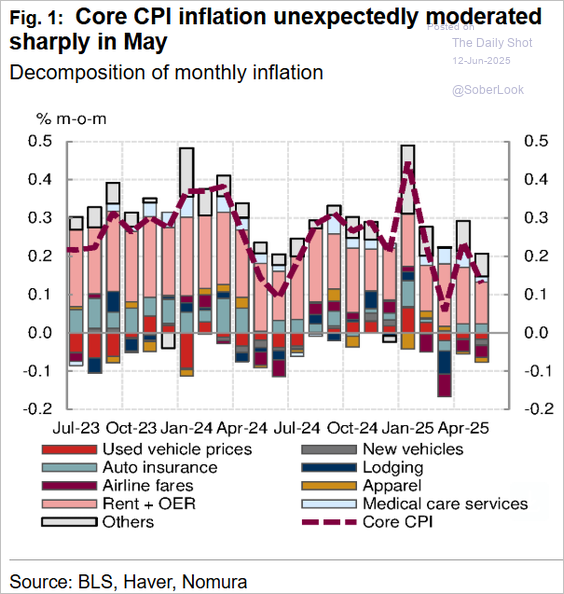

The Consumer Price Index (CPI) rose less than economists expected in May, a promising sign during the first full month with some tariff impact. It’s possible that businesses are still in a “wait and see” mode amid the rapid policy changes. Core CPI was pulled lower by price declines in some key categories, which may be a double-edged sword. Price stability is good, but falling prices can indicate weak demand, which is a negative for corporate earnings. Home sales. Searching for yield. How’s the weather?

1. Inflation remains on an encouraging trend:

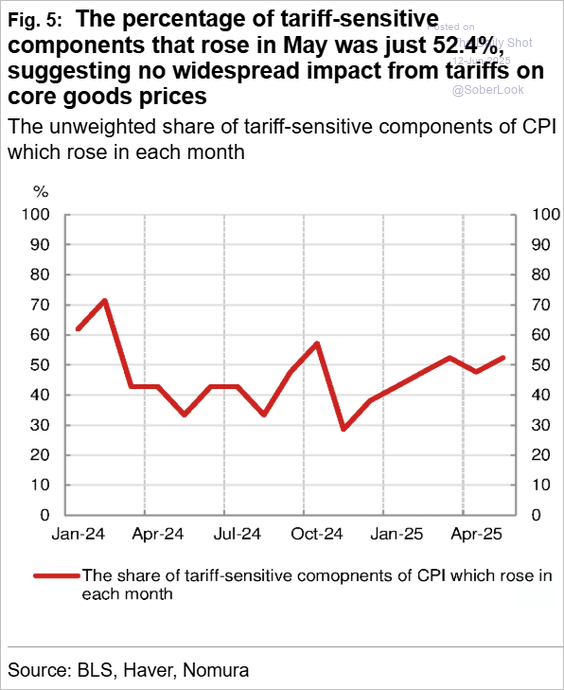

2. Tariffs haven’t had a major impact on prices yet:

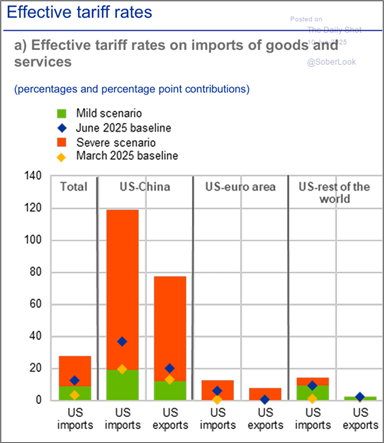

3. Current tariff rates are higher than anticipated prior to “Liberation Day,” yet they’re now well below the worst-case scenario:

4. Airline fares along with both new and used vehicle prices declined in May:

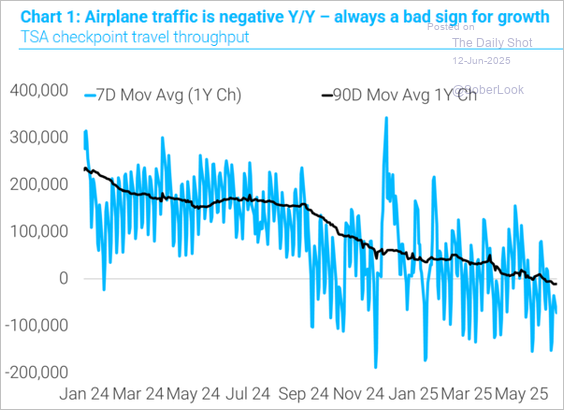

5. Inflation is a delicate balancing act because falling prices may signal falling demand:

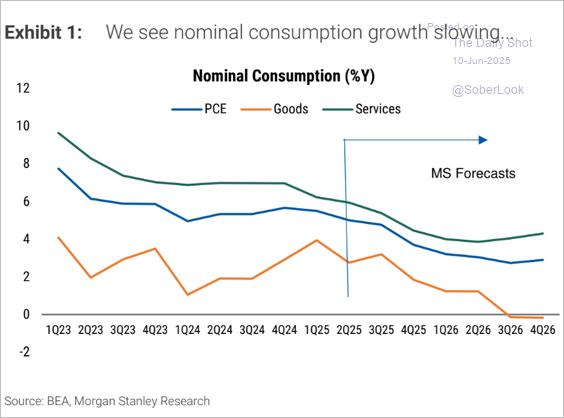

6. Morgan Stanley expects further slowing of nominal consumption growth through the end of 2026:

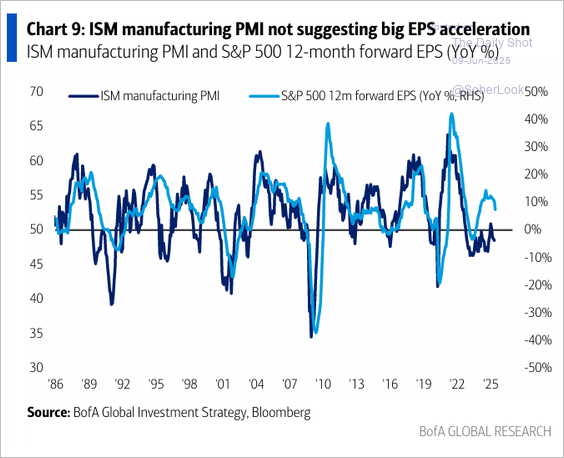

7. The ISM Manufacturing PMI has often led earnings growth:

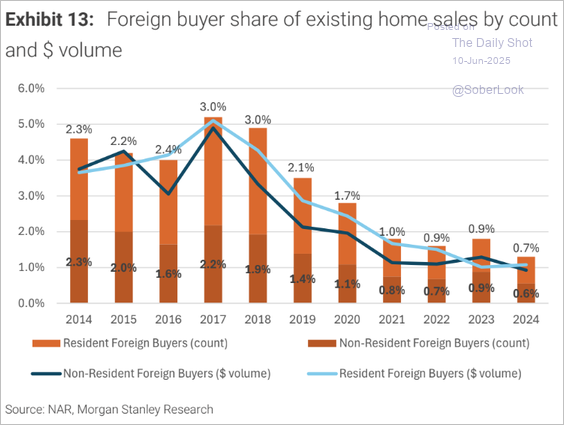

8. Interestingly, the share of existing home sales going to all foreign buyers has dwindled:

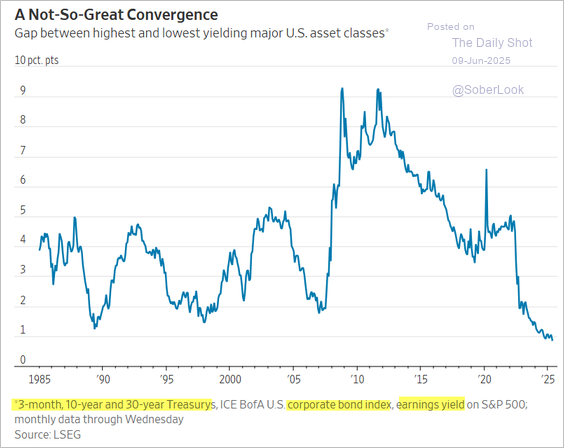

9. Major U.S. asset classes have converged around a similar yield:

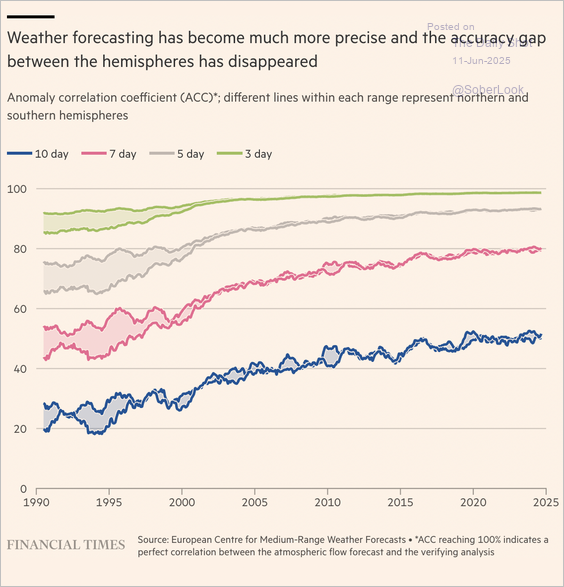

10. Advances in computing power and quantitative methods, such as AI and machine learning, have greatly improved the accuracy of weather forecasting:

Disclosures:

Copyright © 2025 Algorithmic Investment Models LLC (AIM). All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

The federal funds rate is the interest rate at which banks lend money to each other overnight. A treasury yield is the interest rate the U.S. government pays on its debt, and the annual return that investors can expect from holding a U.S. government security. The U.S. Dollar Index is a geometrically-averaged calculation of six currencies weighted against the U.S. dollar. The Russell 2000 Index is a benchmark for U.S. small-cap stocks, measuring the performance of the 2,000 smallest companies in the broader Russell 3000 Index. The S&P 400 Index, also known as the S&P MidCap 400, measures the performance of 400 mid-sized U.S. companies and serves as a benchmark for the mid-cap segment of the market. The S&P 500 Index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. across various industries.

Please contact your AIM Regional Consultant for more information or to address any questions that you may have.

Algorithmic Investment Models LLC (AIM), 125 Newbury St. 4th Floor, Boston, MA 02116 (844-401-7699)